OnFin, a brokerage firm operating since 2015, has steadily gained attention in the financial trading world for its ECN-based technology, competitive trading conditions, and user-friendly approach. Formerly known as ECN.Broker, OnFin has rebranded and expanded its offerings to cater to both novice and experienced traders. This review explores the strengths of OnFin, highlighting its key features, trading platforms, account types, and overall value proposition. With a Trustpilot rating of 4.7/5 based on numerous user reviews, OnFin has established itself as a reliable choice for traders seeking transparency, low costs, and a robust trading environment. Below, we dive into why OnFin stands out in the crowded brokerage market.

Company Overview

OnFin, headquartered in Mohéli, Comoros Union, operates under the license of the Mwali International Services Authority (MISA, license number BFX2024038). While this regulatory body may not be as stringent as top-tier regulators like the SEC or FCA, OnFin’s commitment to transparency and client satisfaction has earned it a solid reputation. The broker leverages partnerships with top-tier liquidity providers such as Bank of America, UBS Group AG, Barclays, and JPMorgan Chase through AMTS Solutions, ensuring tight spreads and ultra-fast order execution.

Key Highlights of OnFin

- Founded: 2015 (as ECN.Broker)

- Regulation: Licensed by MISA (Mohéli, Comoros)

- Trading Platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5)

- Minimum Deposit: $1 (Mini Account)

- Leverage: Up to 1:1000

- Instruments: Over 260, including Forex, CFDs, cryptocurrencies, metals, indices, and shares

- Deposit/Withdrawal Fees: None (though payment providers may charge)

- Trustpilot Rating: 4.7/5 (based on 60+ reviews)

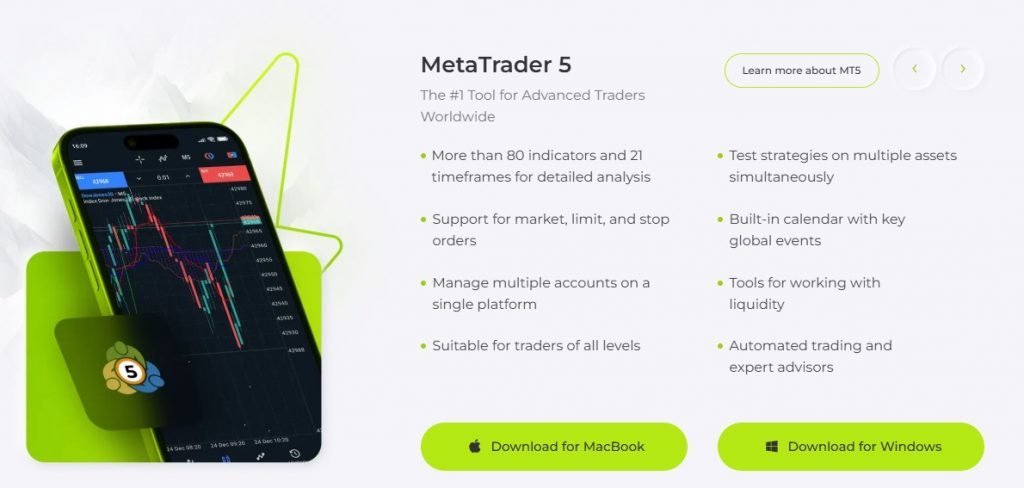

Trading Platforms: MetaTrader 4 and 5

OnFin’s choice of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as its primary trading platforms is a significant advantage for traders. These industry-standard platforms are renowned for their reliability, flexibility, and comprehensive tools. Available on desktop, Android, and iOS devices, they ensure seamless trading across various environments.

Why MetaTrader Stands Out

- User-Friendly Interface: MT4 and MT5 offer intuitive navigation, making them suitable for beginners while providing advanced tools for professionals.

- Technical Analysis Tools: Both platforms include charting tools, indicators, and customizable templates for in-depth market analysis.

- Automated Trading: Support for Expert Advisors (EAs) allows traders to automate strategies, a feature highly valued by algorithmic traders.

- Mobile Trading: The mobile apps enable real-time trade management, ensuring traders can react to market changes on the go.

- Multi-Platform Support: Compatibility with Windows, macOS, iOS, and Android ensures accessibility for all users.

OnFin’s implementation of MT4 and MT5 is enhanced by its ECN technology, which provides direct market access and eliminates requotes. Traders benefit from execution speeds of less than 1 millisecond, making OnFin ideal for scalping and high-frequency trading strategies.

Account Types: Flexibility for All Traders

OnFin offers four distinct account types to cater to diverse trading needs: Mini, Fix, ECN, and Copy. Each account is designed with specific trader profiles in mind, ensuring flexibility and accessibility.

| Account Type | Minimum Deposit | Spreads | Commission | Best For |

|---|---|---|---|---|

| Mini | $1 | Floating from 0.0 pips | None | Beginners, low-budget traders |

| Fix | $50 | Fixed | None | Traders seeking price certainty |

| ECN | $50 | Floating from 0.1 pips | $4 per lot | Professional traders, scalpers |

| Copy | $50 | Floating from 0.0 pips | Varies (profit share, fixed, or periodic) | Copy trading enthusiasts |

Benefits of OnFin’s Account Structure

- Low Entry Barrier: The $1 minimum deposit for the Mini account makes trading accessible to beginners.

- No Commissions on Mini and Fix Accounts: Ideal for cost-conscious traders.

- Copy Trading: The Copy account allows users to replicate trades from experienced strategy providers, with flexible tariff models (profit share, fixed per trade, or periodic fees).

- High Leverage: Up to 1:1000 leverage enables traders to maximize small deposits, though it comes with increased risk.

- Swap-Free Accounts: Available for Islamic traders, ensuring compliance with Sharia law.

The variety of account types ensures that OnFin caters to a broad audience, from those testing the waters with a $1 deposit to seasoned traders leveraging ECN accounts for low spreads and fast execution.

Trading Instruments: A Diverse Portfolio

OnFin provides access to over 260 trading instruments, covering a wide range of asset classes. This diversity allows traders to build varied portfolios and capitalize on different market opportunities.

Available Asset Classes

- Forex: Over 50 currency pairs, including major, minor, and exotic pairs.

- Metals: Gold, Silver, Aluminum, Palladium, and Platinum.

- Indices: Major global indices like ASX200, DAX40, DowJones30, Nikkei 225, and Nasdaq100.

- Shares: Russian and international stocks, including CFDs on popular companies.

- Cryptocurrencies: Bitcoin and other major cryptocurrencies.

- Commodities: Oil and other energy products.

This extensive range ensures traders can diversify their strategies, whether focusing on high-volatility Forex pairs or stable assets like precious metals.

Trading Conditions: Competitive and Transparent

OnFin’s trading conditions are a standout feature, particularly for traders prioritizing low costs and fast execution.

Key Trading Conditions

- Spreads: Floating spreads start from 0.0 pips on Mini and Copy accounts, and 0.1 pips on ECN accounts.

- Leverage: Up to 1:1000, allowing significant position sizing with small capital.

- Execution Speed: Orders are processed in under 1 millisecond, minimizing slippage.

- No Requotes: ECN technology ensures market execution without delays.

- Hedging: Supported with a 50% hedged margin, ideal for risk management.

- Stop Out/Margin Call: 40% Stop Out and 100% Margin Call levels provide flexibility during volatile markets.

These conditions make OnFin particularly appealing for scalpers, day traders, and those employing high-leverage strategies. The absence of deposit and withdrawal fees further enhances its cost-effectiveness, though traders should verify potential fees from payment providers.

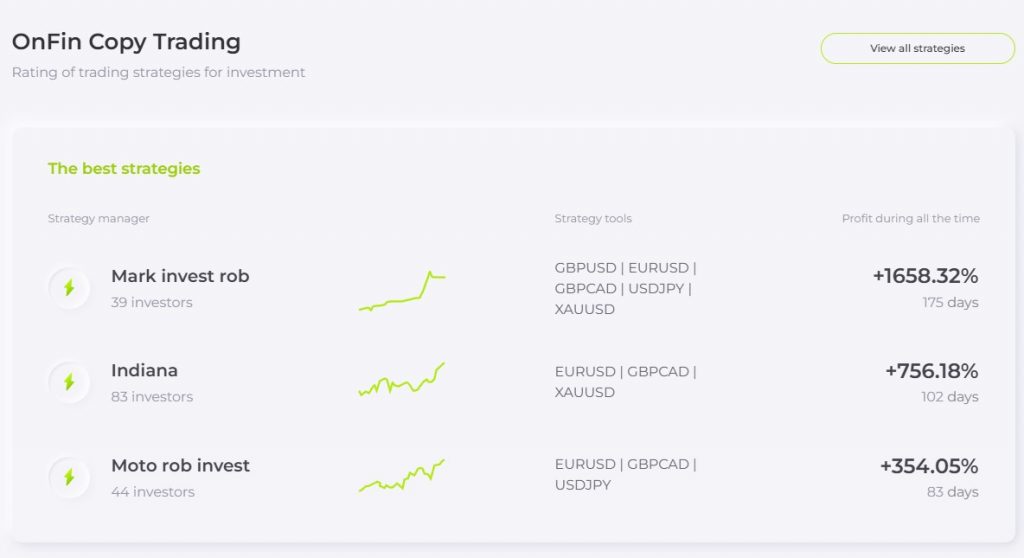

Copy Trading: A Game-Changer for Passive Investors

OnFin’s Copy account is a highlight for those interested in passive trading. This feature allows users to replicate the trades of successful strategy providers, with customizable risk settings and tariff models.

How Copy Trading Works

- Select a Strategy Provider: Choose from over 100 strategies based on performance metrics and risk profiles.

- Set Investment Parameters: Adjust investment size and pause copying if needed.

- Choose a Tariff Model:

- Percent of profit

- Fixed amount per trade

- Subscription for a fixed period

- Monitor Performance: Real-time notifications keep users informed of trade activity.

The Copy account requires a minimum balance of $50 to start copying trades, and new positions won’t be opened if the balance falls below this threshold. This feature is particularly valuable for beginners or those lacking time to trade actively, as it provides access to professional strategies with minimal effort.

Customer Support: Responsive and Accessible

OnFin’s customer support is available 24/7 via email (support@onfin.io), with additional contact options like phone and an office in Tbilisi, Georgia. User reviews consistently praise the support team for its responsiveness and ability to resolve issues promptly.

Support Features

- Availability: 24/7 support ensures assistance at any time.

- Multiple Channels: Email, phone, and in-person support (Tbilisi office).

- Fast Response Times: Most queries are addressed within hours.

- Multilingual Support: Catering to a global audience.

This level of support enhances the trading experience, particularly for beginners who may need guidance navigating the platform or resolving technical issues.

Security and Transparency

OnFin employs SSL technology to protect user data, ensuring secure transactions and safeguarding personal information from third-party interception. The broker’s transparent fee structure, with no hidden charges for deposits or withdrawals, builds trust among users. Additionally, the verification process is streamlined, typically completed within 24 hours, allowing traders to start quickly.

Security Measures

- SSL Encryption: Protects data during transmission.

- Transparent Fees: No hidden costs for deposits or withdrawals.

- Fast Verification: Document uploads via the personal account are processed efficiently.

User Feedback: A Strong Reputation

OnFin’s Trustpilot rating of 4.7/5, based on over 60 reviews, reflects high user satisfaction. Traders highlight the platform’s ease of use, fast execution, and reliable withdrawals. Below are some common themes from user feedback:

- Beginner-Friendly: The $1 minimum deposit and intuitive interface make it easy for new traders to start.

- Fast Execution: Professionals appreciate the instant order execution and lack of requotes.

- Reliable Withdrawals: Many users report smooth withdrawal processes, with funds transferred promptly.

- Copy Trading Success: The Copy account is praised for its transparency and ease of use.

While some users have noted slower withdrawal times (1-2 days), the overall sentiment remains positive, with OnFin being recommended for both beginners and experienced traders.

Deposit and Withdrawal Processes: Seamless and Cost-Effective

OnFin’s deposit and withdrawal processes are designed for convenience, with no broker-imposed fees, ensuring traders retain more of their funds. The platform supports multiple payment methods, catering to a global audience.

Supported Payment Methods

- Bank Cards: Visa, MasterCard

- Bank Transfers: Local and international options

- E-Wallets: Skrill, Neteller, and others

- Cryptocurrencies: Bitcoin, Ethereum, and select altcoins

Key Features of Transactions

- No Broker Fees: OnFin does not charge for deposits or withdrawals, though third-party providers may apply fees.

- Fast Processing: Deposits are instant for most methods; withdrawals typically take 1-2 days.

- Multiple Currencies: Supports USD, EUR, and cryptocurrencies for flexibility.

- Minimum Deposit: As low as $1 for Mini accounts, making it accessible to all.

| Payment Method | Deposit Time | Withdrawal Time | Fees |

|---|---|---|---|

| Bank Card | Instant | 1-2 days | Provider-dependent |

| Bank Transfer | 1-3 days | 1-3 days | Provider-dependent |

| E-Wallets | Instant | Within 24 hours | Minimal or none |

| Cryptocurrency | Instant | Within 24 hours | Network fees |

The streamlined process, combined with low entry barriers, makes OnFin ideal for traders who value efficiency and cost savings. The inclusion of cryptocurrencies as a payment option is a forward-thinking move, appealing to tech-savvy traders.

Mobile Trading: Flexibility on the Go

OnFin’s mobile trading capabilities, powered by MT4 and MT5 mobile apps, ensure traders can manage their portfolios anytime, anywhere. These apps are available for iOS and Android, offering full functionality comparable to desktop versions.

Mobile App Features

- Real-Time Quotes: Access live market data for informed decisions.

- Trade Execution: Place, modify, or close trades instantly.

- Charting Tools: Advanced charting with indicators for technical analysis.

- Account Management: Monitor balances, deposits, and withdrawals.

- Push Notifications: Stay updated on price alerts and trade executions.

The mobile apps are praised for their stability and responsiveness, with users reporting minimal lag even during volatile market conditions. This makes OnFin a strong choice for traders who prefer managing their trades on mobile devices.

Additional Tools and Features

OnFin goes beyond standard brokerage services by offering tools that enhance the trading experience. These include educational resources, analytical tools, and a unique copy trading dashboard.

Educational Resources

OnFin provides a range of educational materials, particularly beneficial for beginners:

- Webinars: Regular sessions on trading strategies and platform features.

- Tutorials: Step-by-step guides on using MT4/MT5 and copy trading.

- Market Analysis: Daily insights from industry experts to inform trading decisions.

Analytical Tools

- Economic Calendar: Tracks key market events to anticipate volatility.

- Technical Indicators: Over 30 built-in indicators on MT4/MT5 for precise analysis.

- AMTS ECN System: Provides real-time market depth for better trade planning.

Copy Trading Dashboard

The copy trading dashboard is a standout feature, offering:

- Performance Metrics: Detailed stats on strategy providers’ success rates and risk levels.

- Risk Management Tools: Options to set loss limits or pause copying.

- Transparent Reporting: Real-time updates on copied trades and profits.

These tools empower traders to make informed decisions, whether they are actively trading or relying on copy trading for passive income.

Regulation and Trustworthiness

While OnFin is regulated by the Mwali International Services Authority (MISA), which is considered a lighter regulatory body, the broker compensates with robust security measures and a strong track record. Its partnerships with reputable liquidity providers and use of SSL encryption bolster its credibility.

Trust-Building Factors

- Liquidity Providers: Partnerships with major banks ensure reliable pricing.

- Client Fund Protection: Funds are held in segregated accounts.

- Transparent Operations: Clear disclosure of fees and trading conditions.

User reviews on platforms like Trustpilot highlight OnFin’s reliability, with many traders noting consistent performance and timely payouts.

Advantages for Different Trader Types

OnFin’s offerings are tailored to suit various trading styles, making it a versatile platform.

For Beginners

- Low Minimum Deposit: Start trading with just $1.

- User-Friendly Platforms: MT4/MT5’s intuitive design simplifies trading.

- Copy Trading: Learn from experienced traders without active involvement.

- Educational Support: Access to webinars and tutorials accelerates learning.

For Experienced Traders

- ECN Accounts: Low spreads and fast execution for high-frequency trading.

- High Leverage: Up to 1:1000 for maximizing returns.

- Diverse Instruments: Over 260 assets for portfolio diversification.

- Advanced Tools: Technical indicators and market depth for strategic trading.

For Passive Investors

- Copy Trading: Replicate expert strategies with customizable risk settings.

- Flexible Tariffs: Choose profit-sharing or fixed-fee models.

- Low Maintenance: Minimal effort required to manage investments.

This adaptability ensures OnFin meets the needs of a wide range of traders, from novices to professionals.

Community and Social Engagement

OnFin fosters a sense of community through its social trading features and active presence on platforms like Telegram and Instagram. Traders can connect, share strategies, and stay updated on market trends.

Community Features

- Telegram Channel: Regular updates on market news and platform features.

- Social Trading: Copy trading fosters collaboration between new and experienced traders.

- User Feedback: OnFin actively responds to reviews, addressing concerns and improving services.

This engagement enhances the trader experience, creating a supportive environment for learning and growth.

Potential Areas for Improvement

While OnFin excels in many areas, there are aspects where it could enhance its offerings:

- Regulation: A license from a top-tier regulator (e.g., FCA, ASIC) could further boost credibility.

- Educational Content: Expanding video tutorials and advanced strategy guides would benefit seasoned traders.

- Withdrawal Speed: While generally fast, some users report occasional delays of up to 2 days.

These areas, while minor, could elevate OnFin’s standing further if addressed.